Decoupled: Wages and CPI are on a break from one another.

CPI is inflated due to:

- disruption in energy transition,

- increased government spending,

- cash injections from the Bank of Canada, and

- pandemic shifts,

all of which increase the risk for employers and do not translate to job creators being able to afford increased wages for their employees.

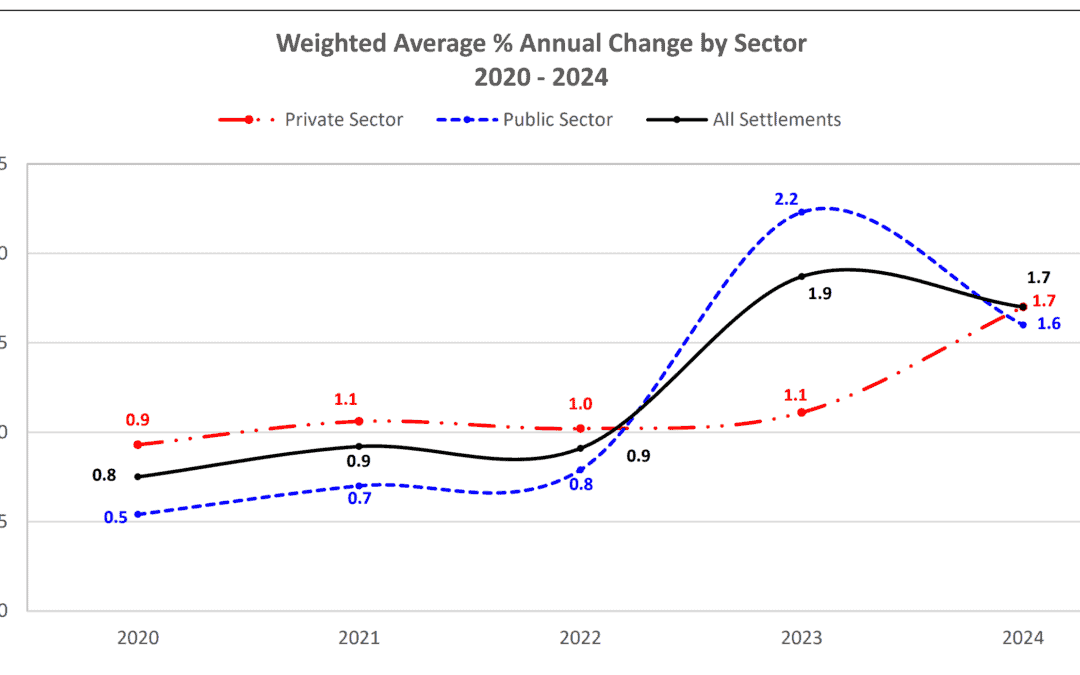

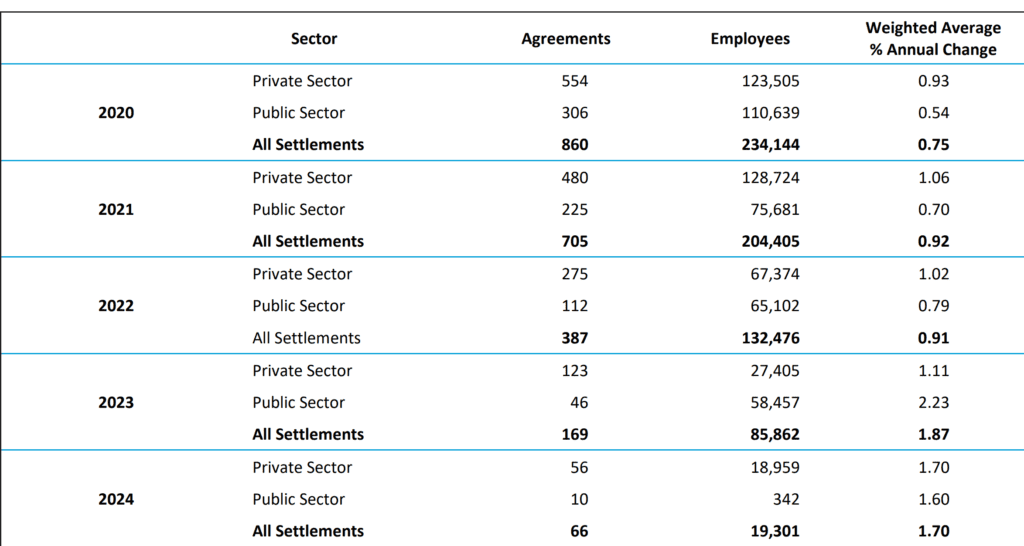

The increased business risk driving increased CPI has significant implications for wage adjustment considerations and collective agreement negotiations.

The path of least resistance, and at times lazy approach labour relations and human resources practitioners take when considering wage adjustment, is blindly following CPI increases. That is precisely the type of thinking that reduces the confidence executive leadership has in labour relations and human resources personnel and reduces their usefulness and effectiveness to the organization.

Wages and collective agreement targets must be driven by fulsome reviews of such adjustments’ affordability, sustainability, and prudence. This analysis and determination must ensure that operations and employment continues to be a going concern, presently and into the future.

CPI and wages are not automatically linked, nor should they be. Human resources and labour relations practitioners would be wise to test the business fundamentals before making promises they can’t keep with their union counterparts. Granting unsustainable wags increases helps no one if it results in shrinking operations and layoffs.

Please visit our home page or our news and knowledge centre for more information.

Respectfully submitted,

Sam Kemble

Executive Operating Officer

With People Inc.

(780) 886-1679

Recent Comments